When you open your bank account, you get a checkbook to transfer your money to others or for your use. For this reason, you probably know how to fill the check appropriately. Whenever we first fill a review, we might think that it is troublesome and maybe a little perplexed regarding what to write?

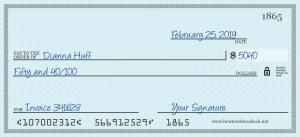

The principal thing we want to fill in the check is the date of that particular day. Compose the date at the upper right corner of the examination. This is a significant one, so the individual or the bank representative knows the date when you composed it. The subsequent stage is to write the name of the individual or organization you are giving that check to. You can even write “cash” on the off chance that you are obscure to the beneficiary’s name. In any case, this ends up being extremely dangerous as though the check at any point got taken or lost; anyone can cash it as it doesn’t have a particular name.

How to fill out a check?

While summing up what you are paying, you might have found two spots in line where you must insert them. It is suggested that you begin your process by writing the sum in numerical form. Guarantee you write the right sum. Then, at that point, write the sum in alphabetical order. Do write it effectively and affirm that you enter a similar sum in numbers. It is critical to write in words to confirm the total payment and process the check.

The important step is to write your name in the lower right corner of the check. Use the signature you first used when you opened the account in the bank. Referencing your name is verification that you give the amount to the right person or consent to the terms. Another box is also there with the phrase “memo.” It is an unofficial reference and does not affect the check. It is for your remembrance of the payment.

Bottom Line

On the off chance that you make an installment through a check, the check number can be recorded in the upper right corner of the examination. It assists you with monitoring your assessments and guarantees that your statements are not generally missing. Additionally, please note your exchange, so you recall where the installment was made and for what reason its utilization.

When the monthly bank statement comes, check the balance in the checking amount. After you write the check, make sure to record the payment. Check-register is an optimal spot for this. Identify extortion and burglary in your financial records. You can likewise take a look at the register by yourself. Write the check number, the date you write that specific check, the depiction and name of the individual you write that check, and the complete payment you are providing to that person. This is double-checking your transaction to ensure that the bank and you have the same records.

Also read: how to get rid of a yeast infection.